All Categories

Featured

There is no one-size-fits-all when it comes to life insurance./ wp-end-tag > In your hectic life, economic independence can appear like an impossible goal.

Less employers are providing standard pension plan strategies and lots of business have reduced or ceased their retirement plans and your capacity to count entirely on social safety is in inquiry. Also if advantages have not been lowered by the time you retire, social safety and security alone was never ever planned to be sufficient to pay for the lifestyle you want and should have.

/ wp-end-tag > As component of a sound economic method, an indexed universal life insurance policy can assist

you take on whatever the future brings. Before devoting to indexed global life insurance, right here are some pros and cons to think about. If you select an excellent indexed global life insurance policy strategy, you may see your cash money worth expand in value.

Universal Life Insurance Cash Value Withdrawal

Since indexed global life insurance policy needs a particular degree of risk, insurance coverage firms often tend to maintain 6. This type of plan additionally offers.

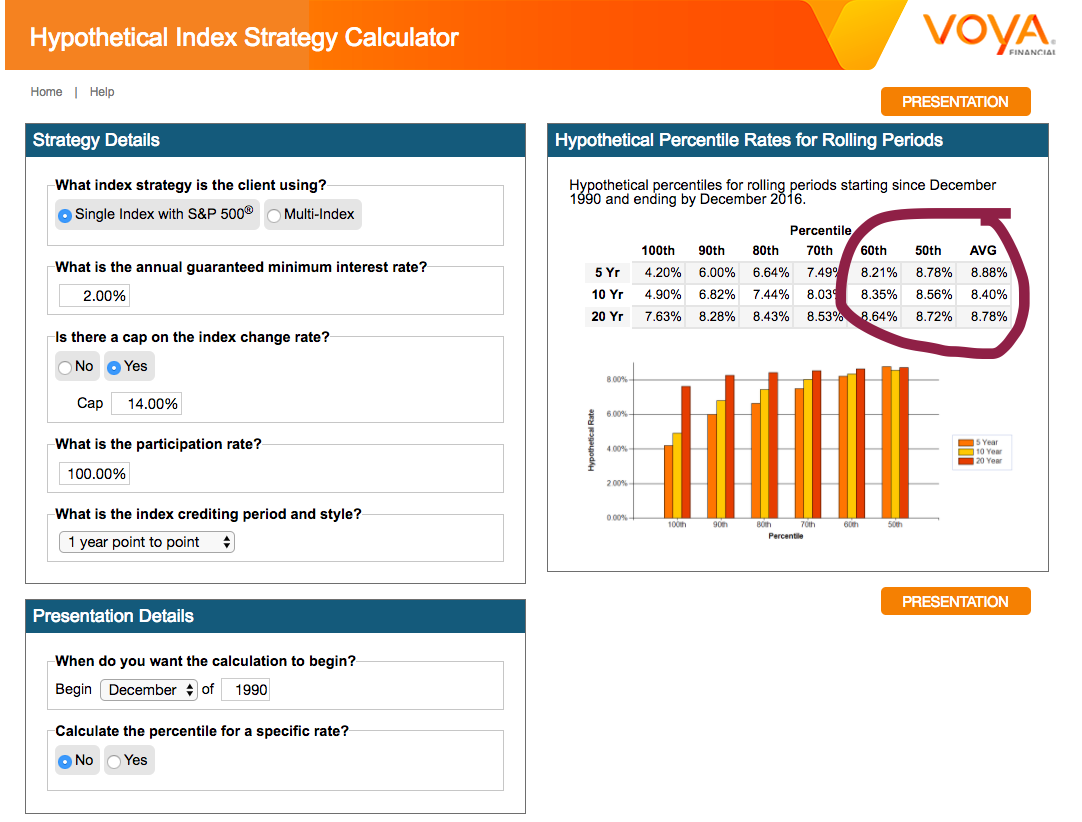

Lastly, if the chosen index doesn't execute well, your cash worth's development will be affected. Commonly, the insurance provider has a vested interest in executing much better than the index11. There is generally an ensured minimum passion price, so your plan's growth will not drop below a particular percentage12. These are all aspects to be thought about when choosing the most effective sort of life insurance policy for you.

Universal Life University

Nevertheless, given that this kind of policy is more complicated and has a financial investment part, it can commonly include greater costs than other policies like entire life or term life insurance policy. If you do not assume indexed universal life insurance policy is appropriate for you, right here are some choices to take into consideration: Term life insurance is a momentary plan that usually uses insurance coverage for 10 to thirty years.

When choosing whether indexed universal life insurance policy is appropriate for you, it's crucial to think about all your options. Entire life insurance might be a better option if you are seeking more stability and consistency. On the other hand, term life insurance coverage might be a far better fit if you only require protection for a particular time period. Indexed global life insurance policy is a kind of policy that provides much more control and adaptability, in addition to greater cash money worth development capacity. While we do not provide indexed universal life insurance, we can supply you with more information regarding whole and term life insurance policy policies. We advise checking out all your alternatives and talking with an Aflac agent to uncover the most effective fit for you and your family.

The rest is included in the cash money worth of the policy after costs are subtracted. The cash worth is credited on a month-to-month or yearly basis with passion based on boosts in an equity index. While IUL insurance coverage might show useful to some, it is necessary to understand how it functions prior to acquiring a plan.

Latest Posts

Maximum Funded Tax Advantaged Insurance Contracts

Iul Nationwide

Indexed Universal Life Express Mutual Of Omaha