All Categories

Featured

Table of Contents

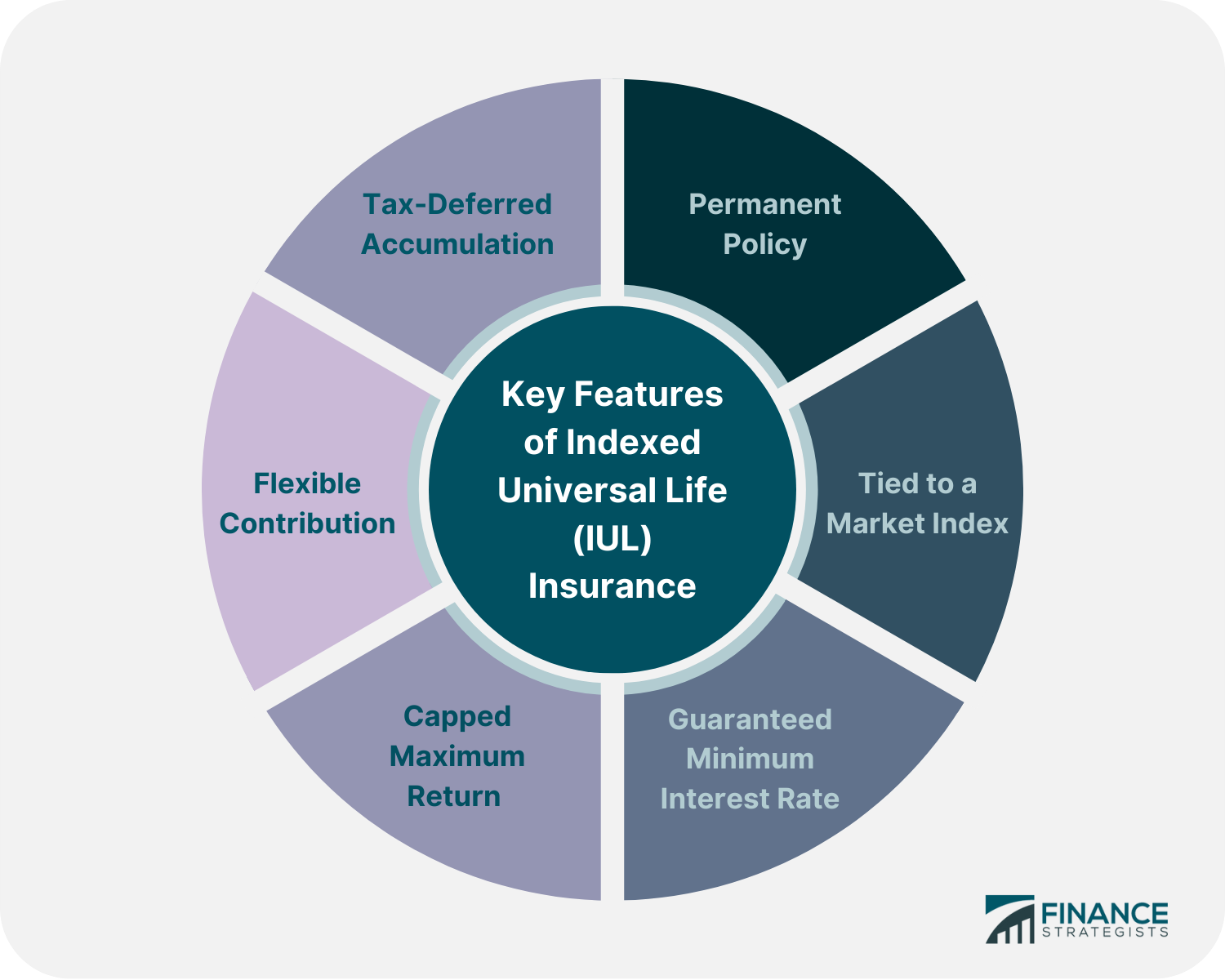

Indexed universal life policies supply a minimal guaranteed rate of interest, also called a passion attributing flooring, which decreases market losses. Say your cash value loses 8%. Numerous companies supply a flooring of 0%, suggesting you won't lose 8% of your investment in this situation. Understand that your money worth can decrease despite having a flooring due to costs and other prices.

It's also best for those happy to assume added danger for greater returns. A IUL is an irreversible life insurance coverage policy that obtains from the residential or commercial properties of a global life insurance policy plan. Like universal life, it permits flexibility in your fatality advantage and premium payments. Unlike universal life, your money value expands based upon the efficiency of market indexes such as the S&P 500 or Nasdaq.

What makes IUL different from various other policies is that a part of the superior repayment goes right into yearly renewable-term life insurance policy. Term life insurance coverage, also understood as pure life insurance coverage, guarantees death advantage payment.

An IUL plan may be the best option for a client if they are looking for a long-lasting insurance policy item that constructs wealth over the life insurance coverage term. This is since it offers prospective for growth and additionally keeps one of the most worth in an unstable market. For those that have significant assets or riches in up-front investments, IUL insurance coverage will certainly be a fantastic wealth monitoring tool, particularly if a person wants a tax-free retired life.

Is Iul Accumulation worth it?

In comparison to various other policies like variable global life insurance coverage, it is much less risky. When it comes to taking care of beneficiaries and taking care of wealth, here are some of the leading factors that a person may select to pick an IUL insurance policy: The money value that can accumulate due to the rate of interest paid does not count toward earnings.

This implies a customer can use their insurance payout rather than dipping into their social security money prior to they prepare to do so. Each policy needs to be customized to the client's personal requirements, specifically if they are managing sizable possessions. The policyholder and the agent can pick the quantity of threat they think about to be suitable for their demands.

IUL is a general easily flexible plan most of the times. Because of the rates of interest of global life insurance policy plans, the price of return that a customer can potentially receive is greater than other insurance coverage. This is since the proprietor and the agent can utilize call alternatives to raise feasible returns.

What does a basic Indexed Universal Life Retirement Planning plan include?

Insurance policy holders may be brought in to an IUL policy due to the fact that they do not pay capital gains on the additional cash money worth of the insurance policy. This can be contrasted to various other policies that call for taxes be paid on any type of cash that is secured. This suggests there's a cash money possession that can be secured at any moment, and the life insurance coverage policyholder would certainly not have to fret about paying tax obligations on the withdrawal.

While there are numerous various benefits for a policyholder to choose this type of life insurance policy, it's except everyone. It is important to allow the consumer understand both sides of the coin. Below are some of one of the most important things to urge a client to consider before going with this choice: There are caps on the returns an insurance policy holder can obtain.

The very best option depends on the client's threat resistance - IUL. While the fees related to an IUL insurance policy are worth it for some customers, it is necessary to be ahead of time with them concerning the costs. There are premium cost costs and other administrative fees that can start to accumulate

No assured passion rateSome other insurance plan provide an interest price that is ensured. This is not the instance for IUL insurance policy. This is fine for some, but for others, the unidentified fluctuations can leave them feeling subjected and insecure. For more information concerning handling indexed universal life insurance policy and suggesting it for certain customers, reach out to Lewis & Ellis today.

What types of Tax-advantaged Indexed Universal Life are available?

Consult your tax obligation, lawful, or accountancy specialist concerning your individual circumstance. 3 An Indexed Universal Life (IUL) policy is not considered a security. Premium and survivor benefit types are versatile. It's crediting price is based upon the performance of a stock index with a cap rate (i.e. 10%), a flooring (i.e.

8 Long-term life insurance policy contains two kinds: whole life and universal life. Money worth expands in a participating whole life plan via rewards, which are proclaimed annually by the firm's board of supervisors and are not assured. Money value expands in a global life plan with attributed rate of interest and decreased insurance policy prices.

How can I secure Indexed Universal Life For Wealth Building quickly?

No issue how well you prepare for the future, there are events in life, both anticipated and unexpected, that can impact the monetary health of you and your liked ones. That's a factor for life insurance. Survivor benefit is normally income-tax-free to beneficiaries. The death advantage that's usually income-tax-free to your recipients can assist ensure your family will be able to preserve their criterion of living, aid them keep their home, or supplement lost earnings.

Things like prospective tax obligation increases, rising cost of living, financial emergencies, and planning for events like university, retirement, and even wedding events. Some sorts of life insurance policy can assist with these and other worries too, such as indexed global life insurance coverage, or simply IUL. With IUL, your policy can be a funds, since it has the prospective to develop value in time.

An index may impact your interest credited, you can not spend or straight get involved in an index. Below, your plan tracks, but is not actually spent in, an exterior market index like the S&P 500 Index.

Fees and costs may minimize plan worths. This interest is locked in. If the market goes down, you won't shed any type of rate of interest due to the decline. You can additionally pick to get fixed rate of interest, one set foreseeable rate of interest price month after month, no matter the market. Due to the fact that no single allocation will certainly be most reliable in all market environments, your financial expert can assist you determine which mix might fit your economic goals.

What happens if I don’t have Indexed Universal Life?

That leaves extra in your plan to potentially maintain expanding over time. Down the roadway, you can access any readily available cash money value with policy financings or withdrawals.

Latest Posts

Maximum Funded Tax Advantaged Insurance Contracts

Iul Nationwide

Indexed Universal Life Express Mutual Of Omaha